The Pros and Cons of Low Down Payment in Used Car Finance

MforceLA

JANUARY 30, 2024

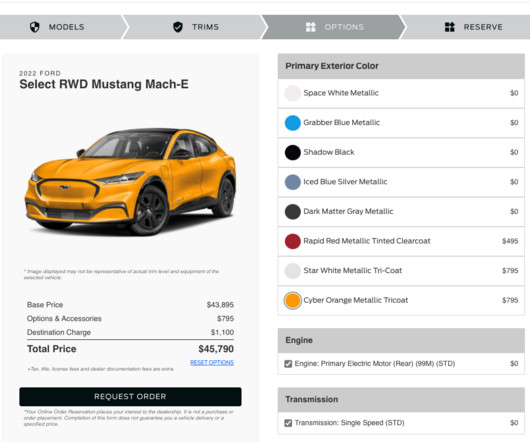

Several critical variables jump into the finance equation, from interest rates to monthly payment terms. When looking for used cars for sale, understanding the finance terms and conditions beforehand is crucial. One of the major factors that influence auto finance is the down payment.

Let's personalize your content