Why You Should Care About Good Credit Auto Financing?

3 Brothers Autosale

DECEMBER 20, 2023

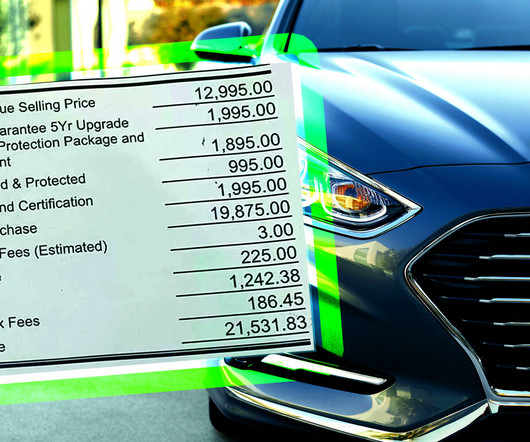

Obtain pre-approval from a financial institution to set a budget and streamline the car-buying process. Consider making a larger down payment, which can further enhance your negotiating power and reduce the borrowed amount. If your credit score has improved since the initial loan, you may qualify for a lower interest rate.

Let's personalize your content