When you DO or DON’T need Gap Insurance💰🚙

Your Car Buying Advocate

MARCH 4, 2025

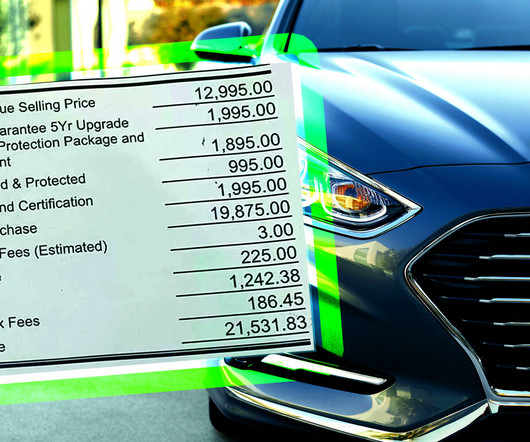

Gap insurance can be a smart option to consider when buying a car. This insurance helps pay off what you still owe if your car gets totaled, and the payout from the insurance doesn’t cover the full loan amount. You might not need it for shorter loans or if you’re making a large down payment.

Let's personalize your content