CULA Grows by Double Digits in 2024, Saves Credit Union Members ~$63M Annually with Vehicle Leases

Dealer World

APRIL 10, 2025

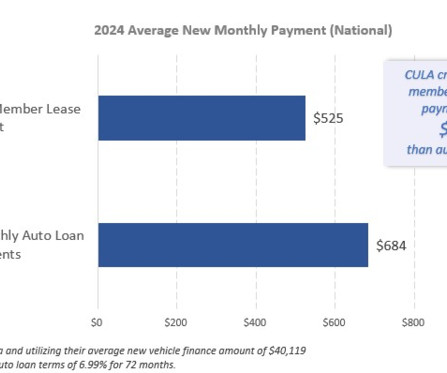

CULA partner credit union members saved a total of more than $63 million on lease payments in 2024, and an average of $159[1] per month versus traditional auto loan payments. These factors reinforce leasing as a compelling alternative to traditional financing and CULAs appeal to a growing number of credit unions. "The

Let's personalize your content