1 In 5 New Car Buyers Took On $1,000+ Monthly Payments In Q4

Carscoops

JANUARY 11, 2025

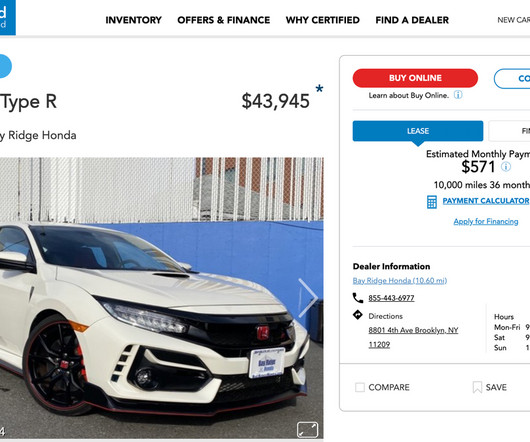

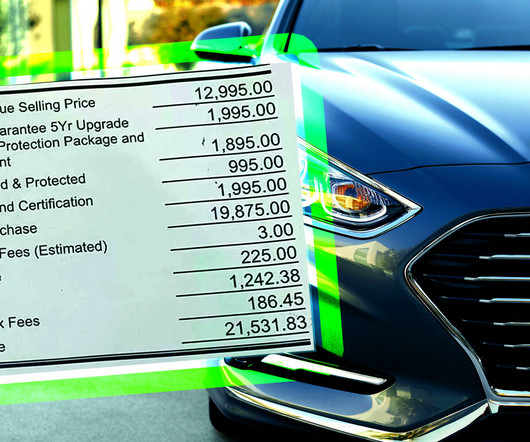

months as down payments fell to $6,856 last quarter. Used car loans average $28,675 with more manageable $533 payments but sky-high 11% APRs. With the cost of financing skyrocketing, analysts are advising potential buyers to consider alternatives, such as used cars or new EV leases, to keep their budgets in check.

Let's personalize your content